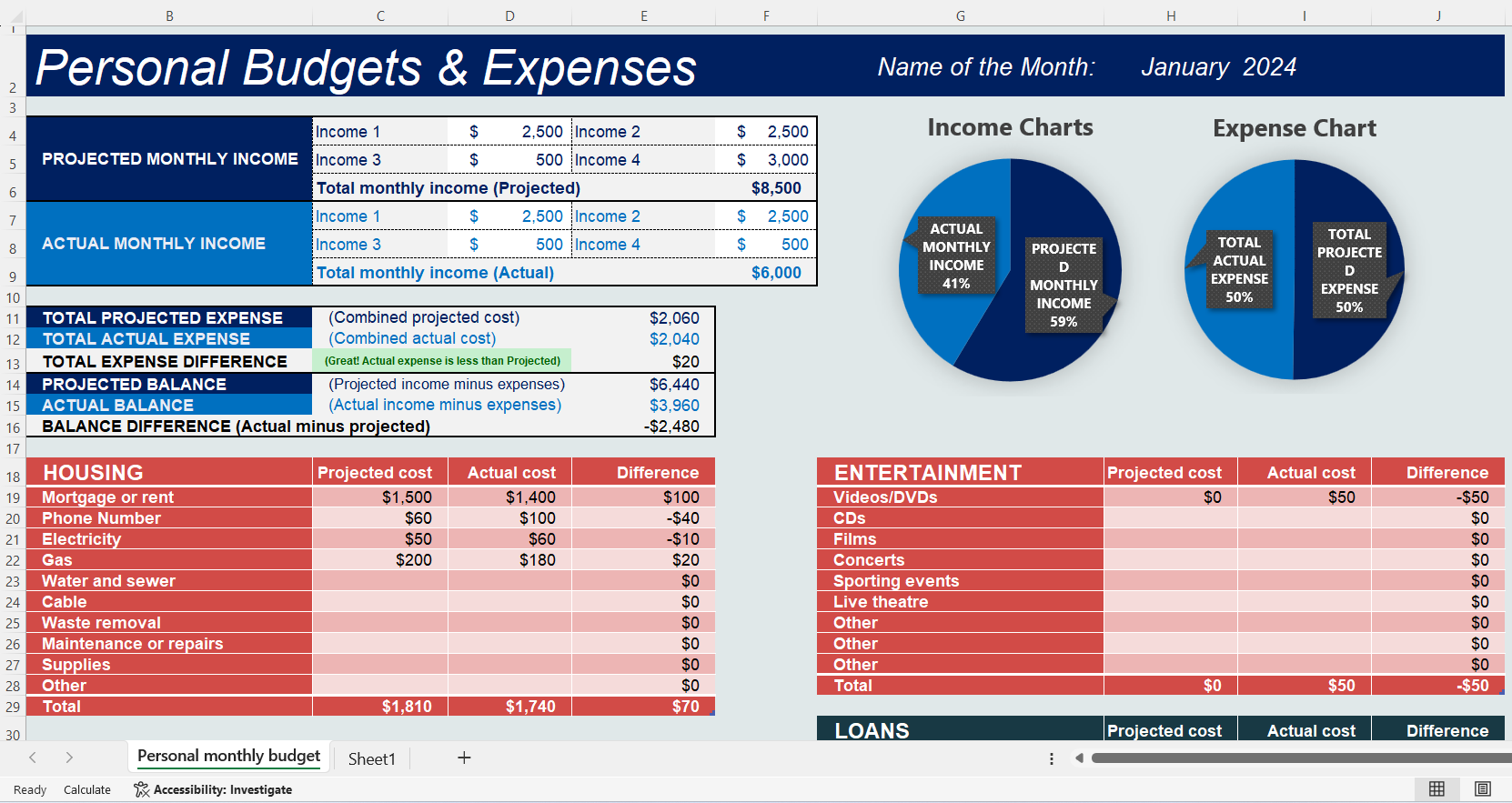

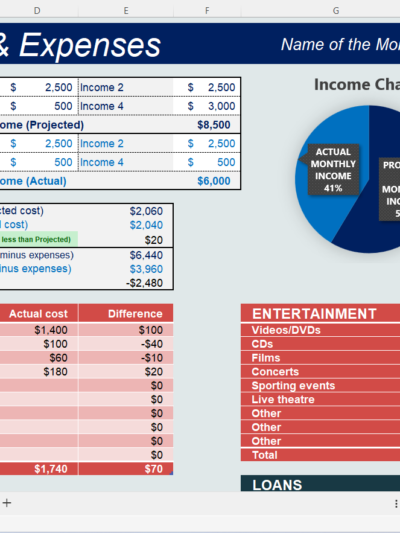

Excel Spreadsheet for Personal Monthly Budget & Expenses offer numerous benefits for individuals looking to manage their finances effectively:

- Financial Awareness: Creating a monthly budget requires individuals to track their income and expenses meticulously. This process enhances financial awareness by providing a clear understanding of where money is being spent and how much is being saved.

- Goal Setting: Budgets enable individuals to set realistic financial goals, such as saving for emergencies, paying off debt, or investing for the future. By allocating funds towards these objectives within the budget, individuals can work towards achieving them systematically.

- Control Over Spending: Tracking expenses allows individuals to identify areas where they may be overspending and make adjustments accordingly. This control helps in curbing unnecessary expenses and promoting responsible financial behavior.

- Debt Management: Budgeting facilitates better management of debt by allocating funds towards debt repayment each month. By prioritizing high-interest debts and consistently making payments, individuals can work towards reducing their overall debt burden.

- Emergency Preparedness: Budgeting encourages individuals to allocate funds towards building an emergency savings fund. Having a financial buffer can provide peace of mind and help cover unexpected expenses without relying on credit or going into debt.

- Improved Decision Making: With a clear overview of their finances, individuals can make informed decisions regarding purchases, investments, and other financial matters. Budgeting helps in prioritizing spending based on personal values and long-term financial objectives.

- Financial Stability: Consistently following a budget promotes financial stability by ensuring that expenses do not exceed income. This stability can alleviate financial stress and provide a sense of security, even during periods of economic uncertainty.

- Savings Growth: By regularly saving a portion of their income, individuals can build wealth over time. Budgeting allows for intentional savings contributions, whether towards retirement accounts, investment portfolios, or other long-term savings goals.

- Accountability and Discipline: Following a budget requires discipline and accountability. By adhering to a predefined spending plan, individuals develop positive financial habits that contribute to long-term financial success.

- Long-Term Financial Planning: Budgeting serves as a foundation for long-term financial planning. By consistently reviewing and adjusting the budget as needed, individuals can adapt to changing financial circumstances and work towards achieving their financial aspirations over time.

Overall, Excel Spreadsheet for Personal Monthly Budgets & Expenses provide a roadmap for individuals to navigate their finances effectively, leading to greater financial stability, security, and prosperity in the long run. So, download Excel Spreadsheet for Monthly Personal Budgets & Expenses from SoluProject.

sohelfrombd (verified owner) –

Such an amazing template, it makes my life easier.